Renters Insurance in and around Las Vegas

Renters of Las Vegas, State Farm can cover you

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

Home Is Where Your Heart Is

It may feel like a lot to think through your sand volleyball league, work, your busy schedule, as well as providers and deductibles for renters insurance. State Farm offers no-nonsense assistance and unmatched coverage for your furniture, clothing and sports equipment in your rented townhome. When trouble knocks on your door, State Farm can help.

Renters of Las Vegas, State Farm can cover you

Your belongings say p-lease and thank you to renters insurance

There's No Place Like Home

You may be questioning if Renters insurance can actually help protect you, but what many renters don't know is that your landlord's insurance generally only covers the structure of the property. How much it would cost to replace your valuables can be substantial. With State Farm's Renters insurance, you have a good neighbor who can help when abrupt water damage from a ruptured pipe occurs.

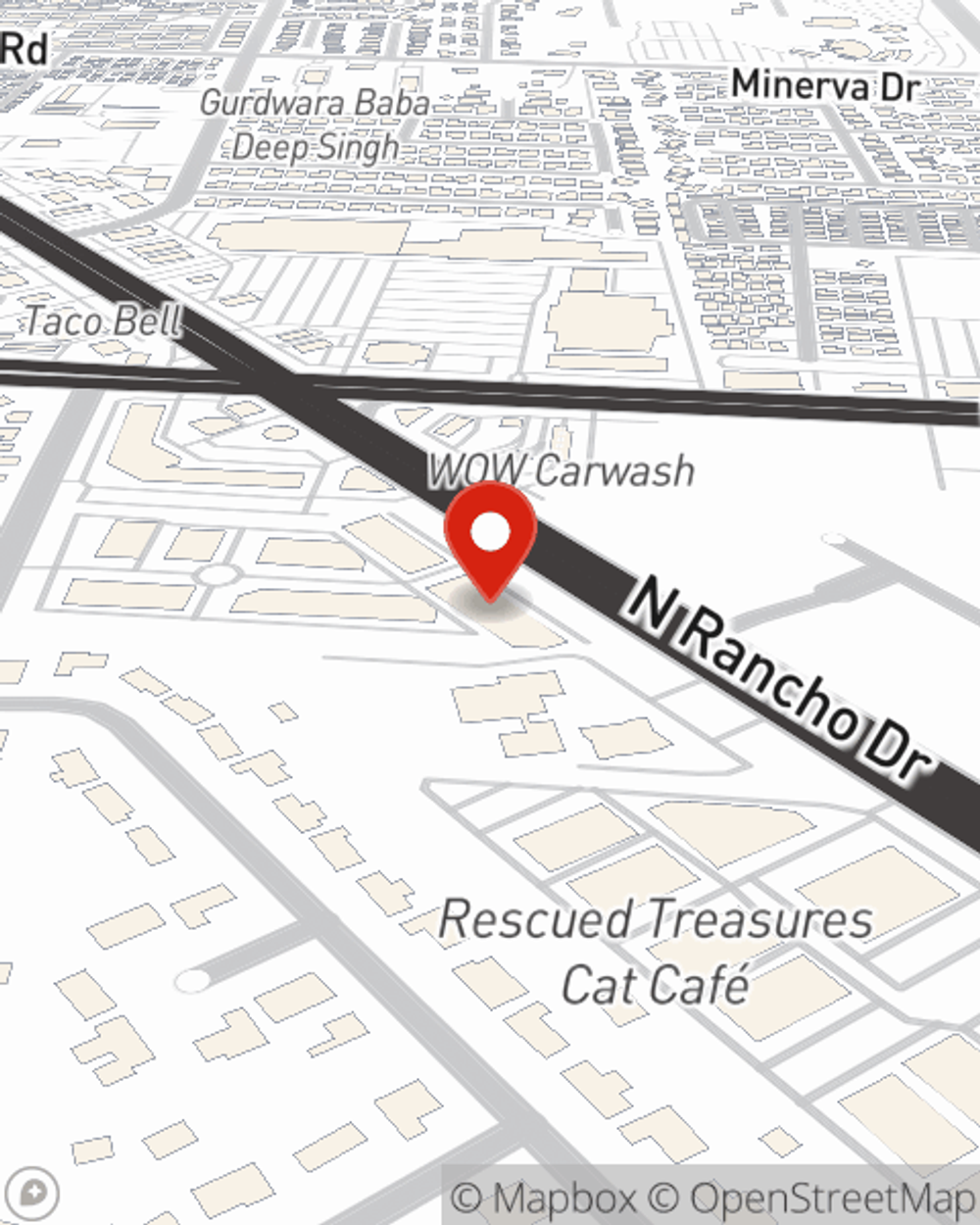

State Farm is a value-driven provider of renters insurance in your neighborhood, Las Vegas. Call or email agent LaDonna Koeller today to learn more about coverage and savings!

Have More Questions About Renters Insurance?

Call LaDonna at (702) 636-9447 or visit our FAQ page.

Simple Insights®

The ins and outs of moving insurance

The ins and outs of moving insurance

Moving insurance can help you stay covered and protect your move. Before you purchase moving insurance, read these basics.

What are landlords responsible for? Learn before you move in

What are landlords responsible for? Learn before you move in

If something goes wrong in your apartment, you need to know how to proceed. Before signing a lease, know your landlord's maintenance responsibilities.

LaDonna Koeller

State Farm® Insurance AgentSimple Insights®

The ins and outs of moving insurance

The ins and outs of moving insurance

Moving insurance can help you stay covered and protect your move. Before you purchase moving insurance, read these basics.

What are landlords responsible for? Learn before you move in

What are landlords responsible for? Learn before you move in

If something goes wrong in your apartment, you need to know how to proceed. Before signing a lease, know your landlord's maintenance responsibilities.